Along with the end of China's rapid economic growth, the problems accumulated over the years are gradually revealed. Expectations of an economic downturn are increasingly becoming the consensus of many investors.

Rich people are choosing to run away with their capital, and some are trying to realize asset appreciation in a declining economy by triple shorting China's ETFs on the U.S. stock market.

I also hold the same view of expectations, especially the implementation of the accompanying policies in Hong Kong, Hong Kong is no longer the previous Hong Kong, capital outflow market shrinkage.

I bought a little YANG one after another since the beginning of the year, and although I made some profit in the middle, I accumulated it until March and counted the loss. That's when I remembered to do some serious math on this fund.

After the calculation, I realized that I began to dive headfirst into the time to take it for granted, thinking that China's stock market fell it will rise, after calculating to know that the stock loss is extremely high, if the timing is not grasped well, completely for the "take their own money to the fund working" fate.

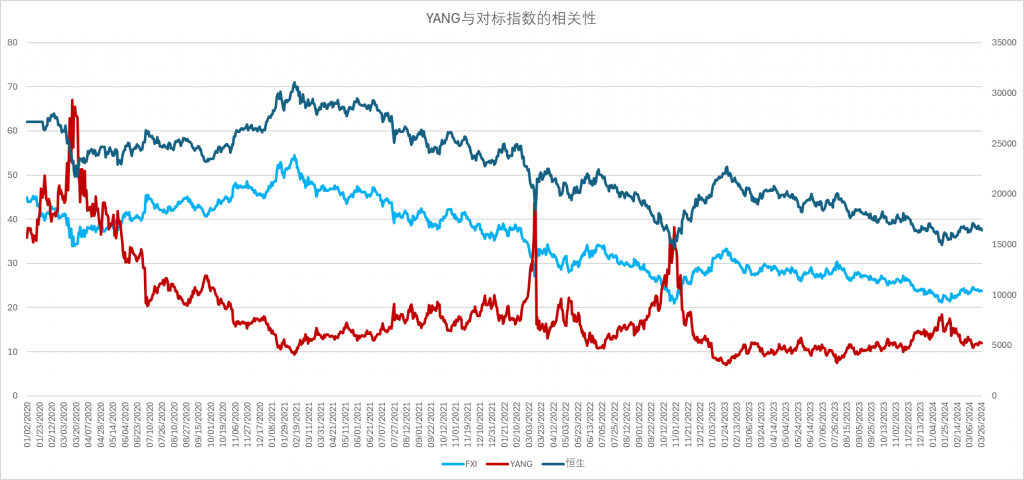

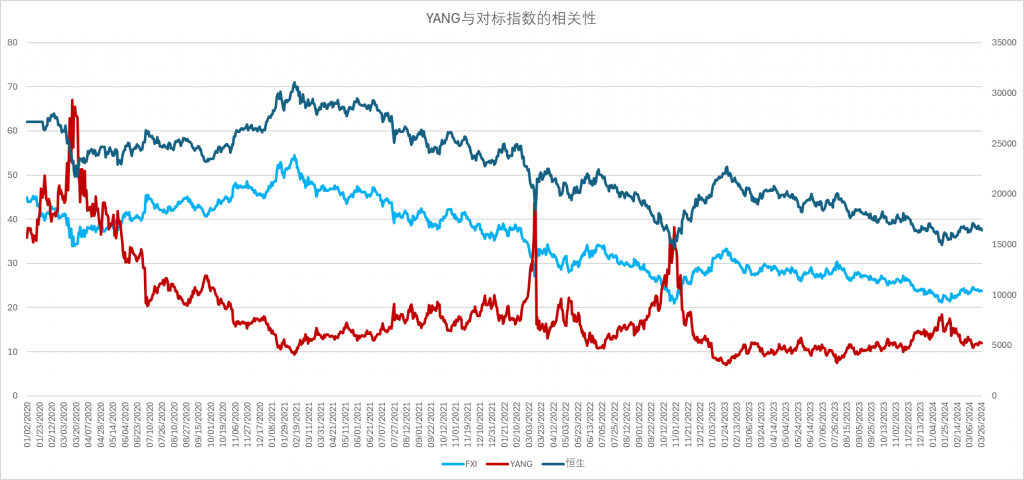

Let's look at some of the correlations between this fund and the control index: the YANG in US stocks tracks not the mainland China index but the China index in Hong Kong. The positive counterpart is in the U.S. stock fund FXI. In terms of long-term trend FXI is basically in line with the overall trend of the Hang Seng Index, and there is not much difference between the two.

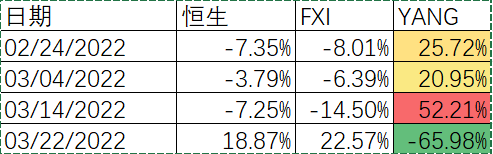

Let's take a look at how much of a drain YANG is, and it should be noted that for simplicity of calculation neither FXI nor YANG's dividend yield is calculated:

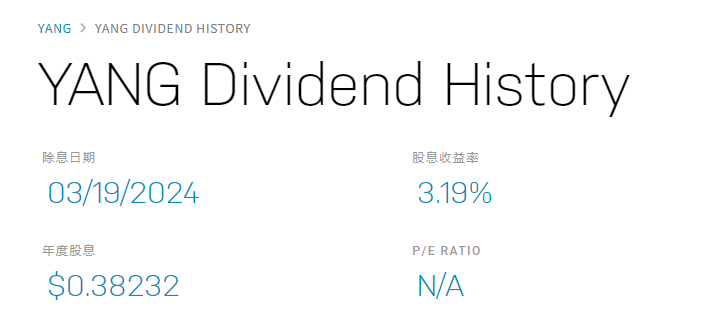

The dividend yield of this etf is not taken into account here, the dividend yield for 2023-2024 is 3.19%, so you can brainstorm in on your own when it comes to the fluctuations later on.

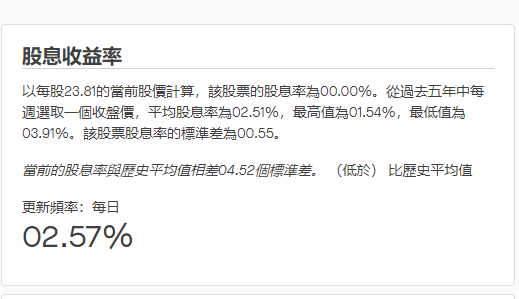

Compare FXI's historical average dividend yield of 2.57%.

As you can clearly see with this table, YANG really isn't a long-term holding, and over the long term deviates greatly from our triple expectation due to depletion.

Taking the Hang Seng Index on the most recent trading day, March 27, the comparisons with 30 days ago and the beginning of the year, respectively, are both slightly down, but the FXI is growing, which is related to the current concentration of hot spots in the Hong Kong stock market. With the FXI growing by 1.49%, it should have fallen by 4.47% according to the reverse triple calculation, but the actual YANG fell by 5.36%. That's 0.89% percentage points higher.

Actually thirty days is okay, if you compare it to the beginning of the year, YANG is down a whopping 14.53% with FXI up 2.45%, depleting it by 7.17%.

If you extend the comparison period even further and look at the 1-4 year yearly ratios, it's shocking. march 2024 vs march 2023 in FXI is down 15%, a triple short should have made 45% but in reality it was only an 11% profit. Compare March 2022 with March 2022, the underlying Hong Kong stocks are down and so is YANG, which is down by no less than the Hong Kong stocks. If you take it from March 2021 to now, there is actually no gain or a loss with HK stocks down almost 50%. If you hold this fund for 4 years, it fell more than HK stocks.

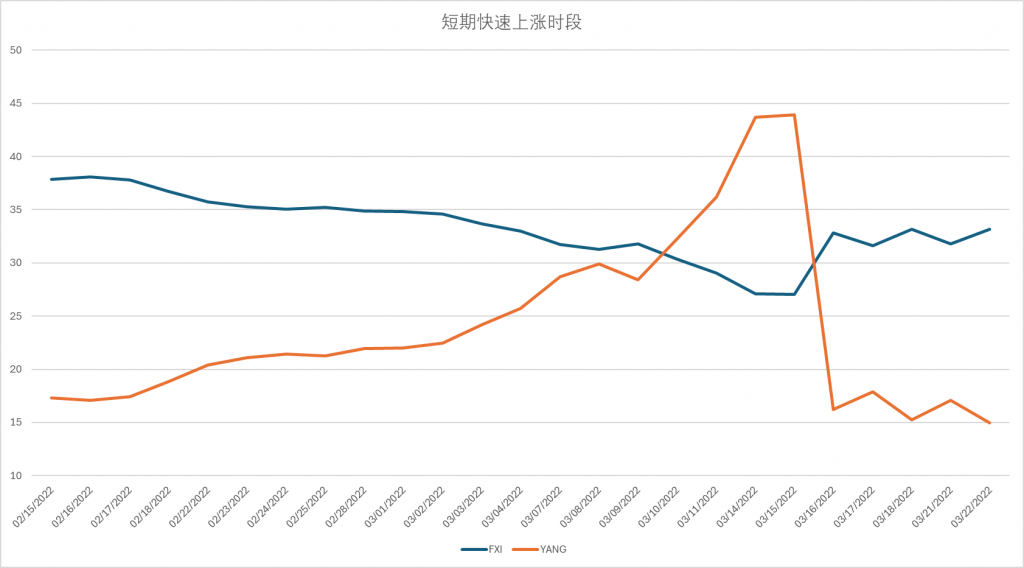

So investing in YANG must be seen to be understood in short-term profits, or else the principal will be lost in the friction of the friction. Going back to the historical trend comparison, although the cost of long-term holding is extremely high, it is still very profitable to buy YANG during some short periods of high volatility.

Over a four-week period from February to March 2022, as the China 50 Index fell rapidly, YANG doubled its returns, the

But if you don't look at the right time to get in and out quickly, you'll be back in the dust after one more week.

Here's an example of why there is depletion:

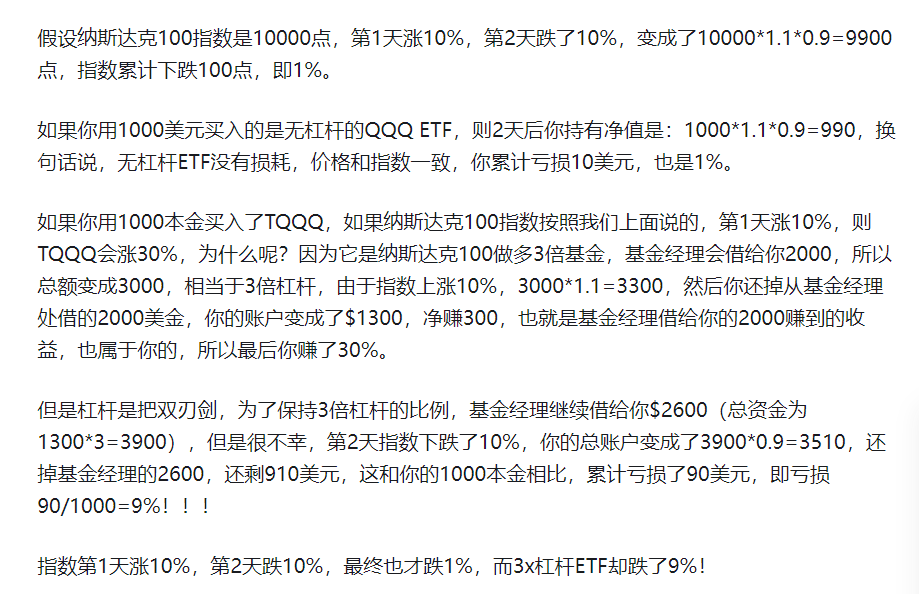

Suppose the Nasdaq 100 is 10,000 points, up 10% on day 1 and down 10% on day 2, becoming 10,000 * 1.1 * 0.9 = 9,900 points, for a cumulative loss of 100 points, or 1%, in the index.

If you bought the unleveraged QQQ ETF for $1,000, your net holding after 2 days would be: 1,000*1.1*0.9=990. In other words, the unleveraged ETF has no loss, the price is in line with the index, and you've accrued a loss of $10, which is also 1%.

If you bought TQQQ with 1000 principal, if the NASDAQ 100 index goes up 10% on day 1 as we said above, TQQQ will go up 30%, why? Because it is the NASDAQ 100 do more 3 times the fund, the fund manager will lend you 2000, so the total amount becomes 3000, equivalent to 3 times leverage, as the index rose 10%, 3000 * 1.1 = 3300, then you pay back the $2000 borrowed from the fund manager, your account becomes $1300, a net income of $300, that is, the fund manager lent you the 2000 earned The earnings, also belong to you, so you end up making 30%.

But leverage is a double-edged sword, in order to maintain the ratio of 3 times leverage, the fund manager continues to lend you $2600 (total capital is 1300*3=3900), but unfortunately, on the 2nd day the index fell by 10%, your total account became 3900*0.9=3510, pay back the fund manager's $2600, and you still have $910 left, which is a cumulative compared to your principal of 1000 loss of $90, i.e. a loss of 90/1000 = 9%!!!!

The index was up 10% on day 1, down 10% on day 2, and ultimately only down 1%, while the 3x leveraged ETF was down 9%!

Obviously, even if the index returns to its original position, this leveraged ETF will not be able to rise back to its original price. This kind of permanent loss due to oscillations is called oscillator loss, and the more volatile the tracked index is, the more obvious the oscillator loss is。

I am into the U.S. stock not too long, and relatively conservative investment style, I hope that before the retirement of stable accumulation of pension, this attempt to let me know the reason for planning before moving. Welcome to follow my channel, if you are a new investor we exchange together snowball, if you are an old investor more guidance do not hesitate to give advice.