September 24, 2024 Bloomberg article Xi Jinping's Stimulus Just Buys China Some Time

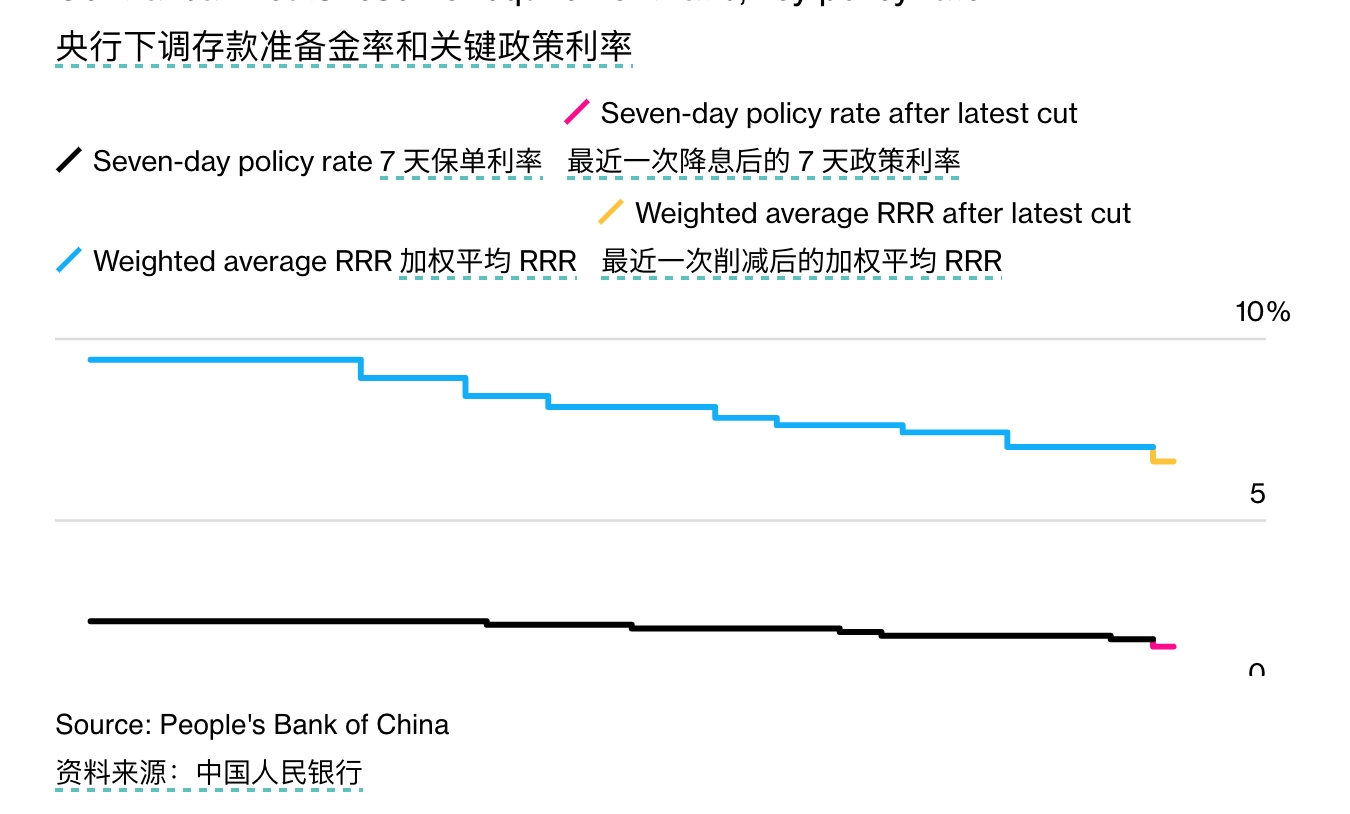

In a rare high-level press conference on Sept. 24, People's Bank of China Governor Pan Gongsheng unveiled a series of bold easing measures in an attempt to inject strength into China's economy, which is on the verge of a deflationary spiral. The series of measures included cutting interest rates, providing more capital to banks, encouraging home purchases and considering the creation of an equity stabilization fund. The policy briefing showed a sense of urgency among China's top brass in the face of the recession.

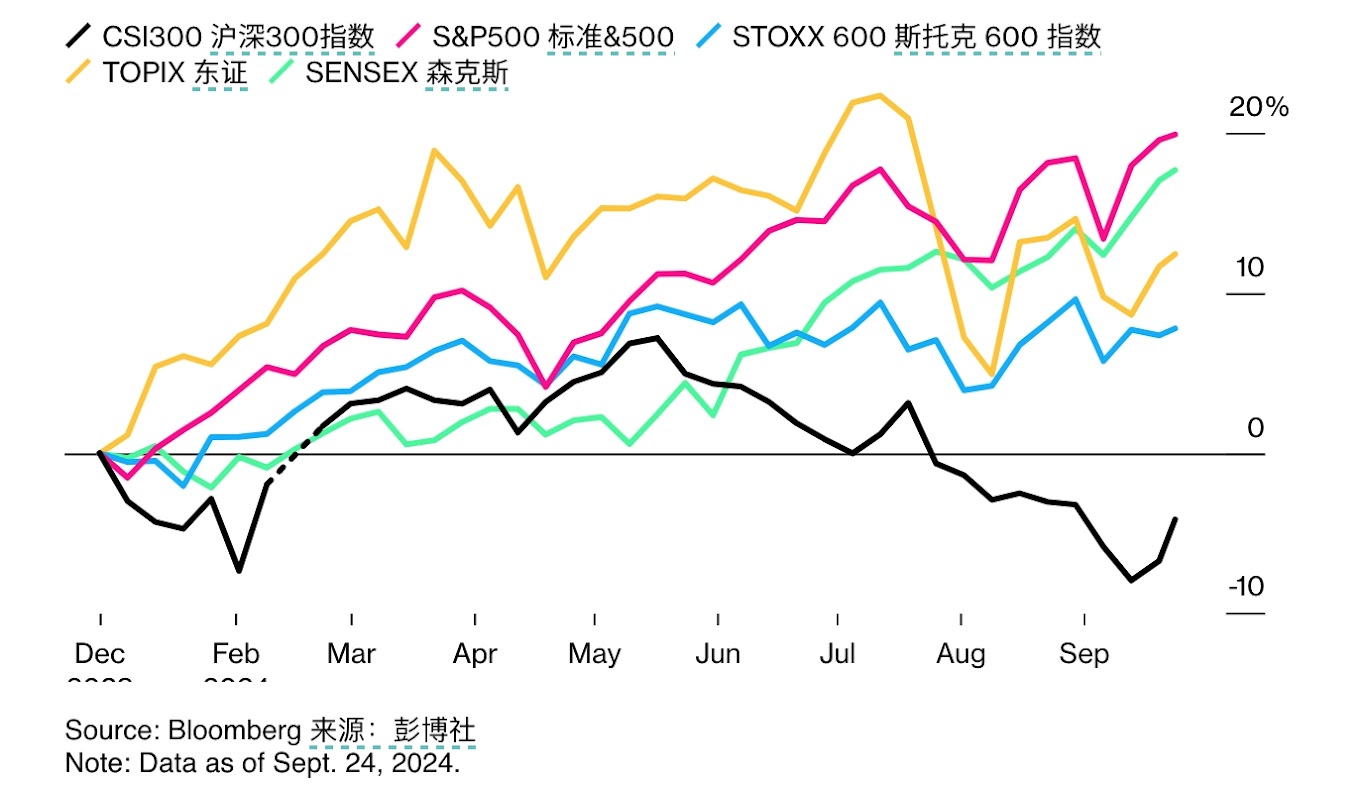

After the launch, stock markets in mainland China and Hong Kong soared, with the CSI 300 Index posting its biggest gain since July 2020, while European and US stock markets also gained in China-linked sectors such as automobile manufacturing and luxury goods. The positive market reaction suggests that Pan's policies have bought valuable time for the Chinese economy. However, economists generally agree that this is only an initial step, and that more deep-seated reforms and stimulus policies are still needed to completely reverse the economic downturn.

Economic context and stress

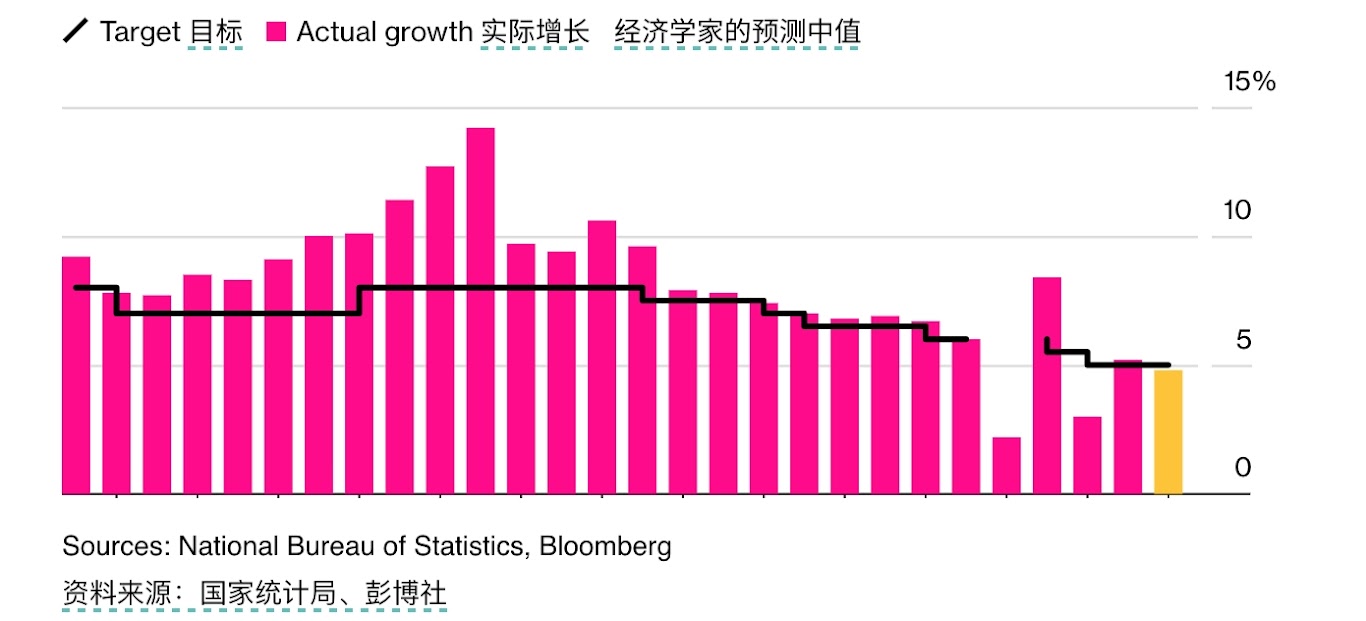

The emergency briefing was hastily arranged two days ago, signaling growing concern at the top level in China about the state of the economy. Senior Chinese government officials have held several closed-door meetings in recent weeks to discuss how to meet annual economic growth targets, especially in some coastal provinces that officials have warned are struggling to meet their GDP targets, according to people familiar with the matter. In the face of these pressures, the top brass finally took action.

Over the past few months, several banks, such as Goldman Sachs and UBS, have lowered their forecasts for China's full-year economic growth, citing weakness in the real estate market, falling prices and heightened global trade tensions. The policy release suggests Beijing is trying to reverse market pessimism about the economic outlook.

While the People's Bank of China's initiatives have won market approval, economists point out that these measures alone will be difficult to solve the complex problems facing China. what China needs is a package of reforms to fundamentally reshape the structure of the economy and unleash the potential for consumption, said Duncan Wrigley, chief China economist at Pantheon Macroeconomics.

Fiscal policy and future challenges

The current focus is gradually shifting to the Ministry of Finance. It is expected that the Ministry of Finance may introduce more stimulus measures in the coming days, especially as the Political Bureau of the Communist Party of China (CPC) Central Committee under Xi Jinping is about to meet before the National Day holiday to celebrate the 75th anniversary of the founding of the People's Republic of China.

However, Beijing is wary of policies that directly stimulate consumption, such as handing out cash subsidies, fearing that this could lead to an unbearable welfare burden. In addition, China's high savings rate has led officials to question whether most residents would actually spend the money even if subsidies were granted.

Nonetheless, the market is looking forward to further financial support, such as increased funding for the purchase of unsold homes, greater social welfare spending and measures to encourage consumers to replace old appliances. The Ministry of Finance may also push local governments to issue more bonds to increase investment in infrastructure development.

Addressing long-term economic challenges

China's conservative approach to economic policy has also sparked internal debate. Xu Qiyuan, deputy director of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences, said that China should not stick to its old fiscal discipline and should significantly increase fiscal spending on education, health care and social security. Xu pointed out that the lesson of Japan is that if expansionary policies are not adopted in time, the consequences will be more serious.

While the stimulus has temporarily eased market concerns, economists generally agree that China needs more structural and long-term reform measures if it is to achieve a sustainable economic recovery. The economic problems that China currently faces are complex and far-reaching, and monetary policy adjustments alone will not solve them completely.

The second article is Bloomberg's September 27th article isChina's economic woes intensify as risk of Japanization emerges

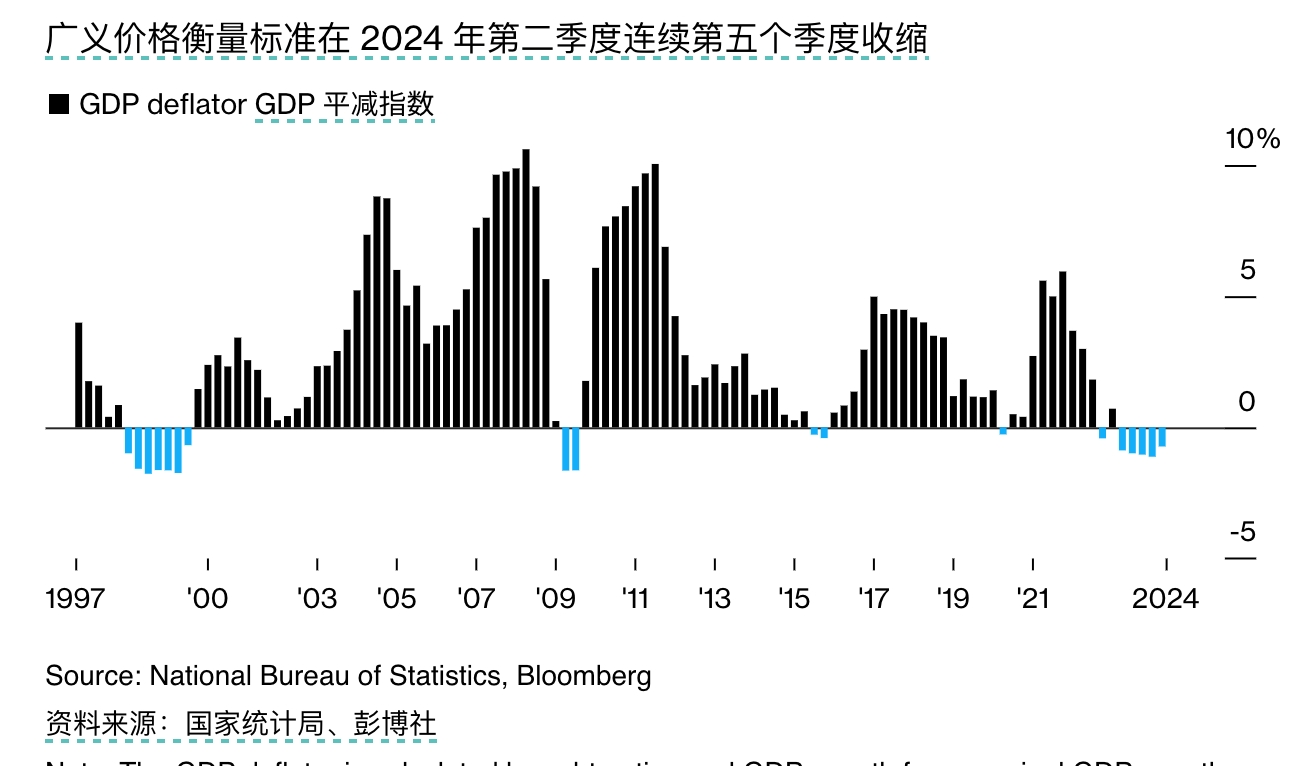

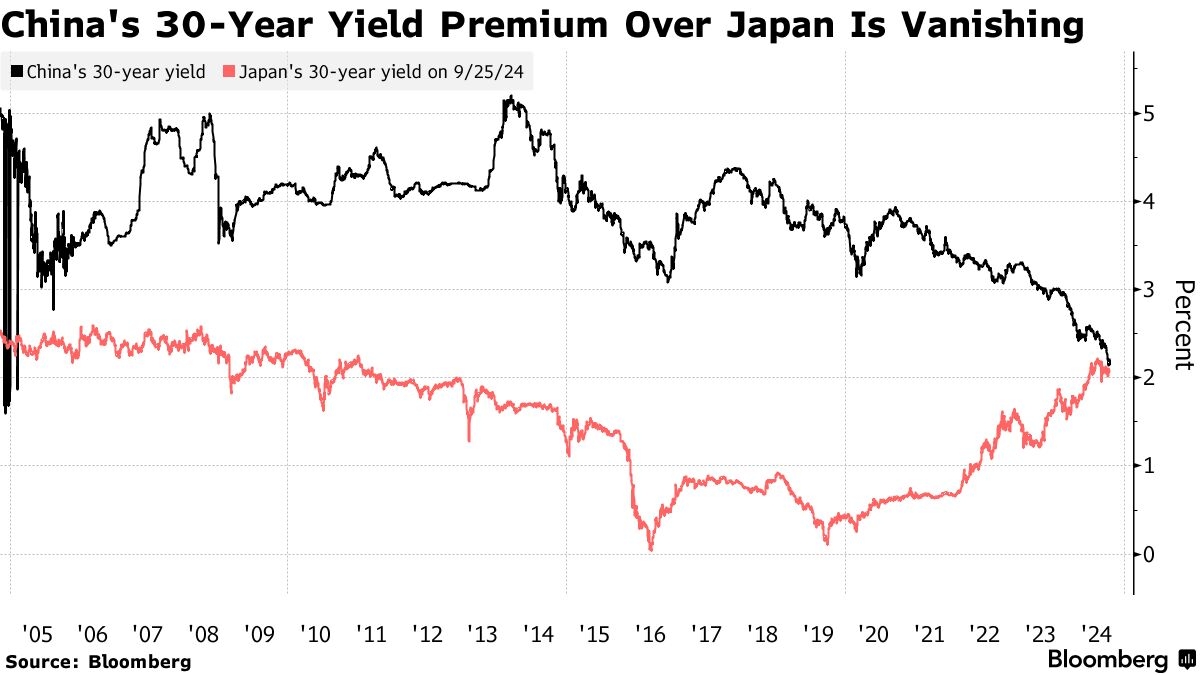

The bond market has provided an important symbolic milestone in the recent debate about China's economy falling into the "Japanization" trap.

China's 30-year Treasury yields are on track to fall below the level of their Japanese counterparts for the first time in almost 20 years. China's long-term bond yields have continued to hit record lows, reflecting a weakening outlook for the world's second-largest economy, while at the same time Japan's long-term yields have climbed to their highest level in 13 years, as the market bets that the country is finally emerging from the shadow of deflation.

China's continued economic malaise, a sluggish real estate market, falling prices and weak demand for credit have fueled concerns that the country could fall into a balance-sheet recession similar to Japan's in the 1990s. Back then, after Japan's real estate crash, consumers and businesses prioritized debt repayment and the economy fell into deflation for decades.

In order to avoid a repeat of Japan's mistakes, the Chinese Government has recently introduced the boldest policy mix in decades. Measures include lowering a number of policy interest rates and considering the creation of a stock market stabilization fund. President Xi Jinping and China's top leadership have also called for greater fiscal spending and support for the real estate sector.

This week, the yield on China's 30-year government bonds fell to 2.14%, the lowest level since 2005, while the yield on similar bonds in Japan rose to about 2.07%. China's economic woes have boosted the safe-haven appeal of bonds, while Japan has seen a wave of selling in the bond market due to the return of inflation and the end of its negative interest rate policy.

Despite the striking economic similarities between China and Japan, there are a number of differences between the two countries' responses to the crisis. First, the People's Bank of China (PBOC) did not resort to unconventional stimulus measures, such as quantitative easing and large-scale bond purchases, as Japan did back then. In addition, the central bank better managed the yield curve by steering long-term yields higher, rather than depressing them as Japan did.

In the bond market, Chinese short-term bonds have much higher yields than their Japanese counterparts. Akira Takei, fixed-income manager at Asset Management One in Tokyo, said: "While China seems to be following Japan's old path, the two countries are responding differently, not least because of the differences in their political systems. The economic challenges facing China, such as deteriorating demographics, are accumulating like lasagna.

Nonetheless, ING Bank says that China's latest stimulus program may still not be enough to dampen market demand for bonds and the downward trend in yields will continue. This means that if the current trend continues, Chinese bond yields could fall further below Japanese levels.

Lynn Song, chief economist for Greater China at ING Bank, noted, "Lower interest rates will once again widen the gap between bank deposits and bonds, so I still think China's long-term treasury yields will continue to fall in the near term, and we'll see capital flowing back into the bond market."